Nobody wants to talk about money.

It’s uncomfortable. It’s considered rude.

It’s also necessary.

If no one’s talking about money, then no one’s learning about it. And experts at UT Extension say everyone needs to understand money.

Current credit card debt in the U.S. totals $887 billion, a 13 percent increase from a year ago, according to the Federal Reserve Bank of New York. Americans’ total household debt now surpasses $16 trillion, while inflation and the cost of necessary goods like groceries are on the rise.

Solid financial habits can help people navigate these complex concepts and the ever-changing financial landscape, but how can people have such skills when they are barely taught the basics?

The UT Extension Family and Consumer Sciences team has a solution: Money Week.

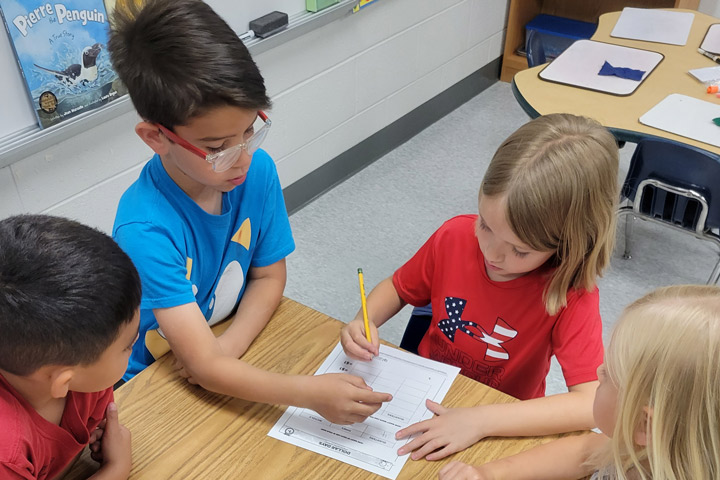

The program—a partnership among UT Extension Family and Consumer Sciences, the Tennessee Financial Literacy Commission and Tennessee elementary schools— is teaching young children in first and second grades the basics of financial education.

“The last thing folks will do is sign up for a financial education program,” says Christopher Sneed (Knoxville ’01, ’03, ’14), a UT Extension consumer economics specialist and assistant professor as well as one of the program’s developers. “So, with Money Week, we’re trying to work on these financial concepts early, in ways that are nonthreatening but still teaching good quality financial concepts.”

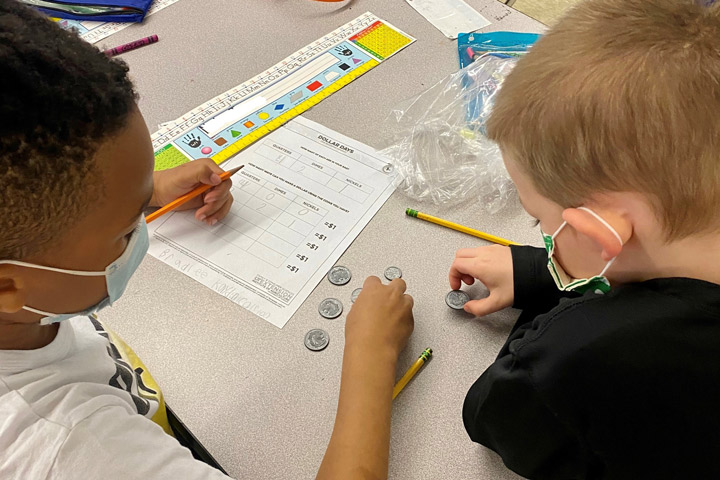

The program’s five lessons, which meet state education standards, implement fun and engaging activities that teach students both basic and more complex money concepts.

When they’re learning about the value in a dollar, for example, the students dig into big tubs of plastic coins to show all the different coin combinations that equal a dollar. When the class covers money management, students make their own “spend, save, share” boxes that allow them to divvy up their personal funds based on what to buy, what to save and what they could share with others who have less.

Each lesson is also accompanied by a children’s book, such as You Can’t Buy a Dinosaur with a Dime, that relates to the day’s topic.

“Reading a book to a child, especially a young child, is the best way to capture their attention,” Madison County Extension Agent Tennille Short says. “When we can link reading and imagination to learning about money, I just think that’s the perfect storm for assisting a child in learning.”

Short must be on to something because what started as a pilot program in just one Knox County school has now expanded to a full-fledged operation in 20 schools across the state.

And the education administered by the program isn’t just staying inside school walls.

During Money Week, daily newsletters displaying what students covered in class are sent home. While students are being set up for financial success, they’re also acting as catalysts for positive change at home and in their communities.

“We’re taking these young people, we’re giving them tools, and they’re taking home tools to share with their families,” says Short. “We’re going to start to see positive change over the next generation just by starting with the little ones.”

Call to Action

Children and adults can learn more about finances through the following resources:

Helping Children Make ‘Cents’ About Money (PDF)

Building an emergency fund (PDF)

Identifying your resources (PDF)

Steps to stabilize your financial situation (PDF W904)