Investing your money can be about as serious as a heart attack.

Unfortunately, not every investment is a wise one. Think of the impulsive trader who buys on the basis of a hot tip, regardless of whether the bulls are raging or the bears are hunkered down.

But if you’re philanthropically motivated and want to invest in a favorite nonprofit institution with little or no risk, then you may want to consider the new charitable IRA rollover. Not only are you assured that your money will be used exactly as you intended, but the process is simple and easy.

Jim and Virginia (Gin) Bibee of Weimar, Texas, learned about it last year through their church. When the longtime UT donors realized the new rollover has no negative tax implications, they acted quickly to ensure that UT, Jim Bibee’s alma mater, would benefit. Unless Congress extends the legislation, the window for this opportunity will close at the end of 2007.

Created by the Pension Protection Act of 2006, the charitable IRA rollover is aimed at donors who are 70-1/2 or older and plan to contribute less than $100,000. “Many retirees may not be aware of this option for their IRAs,” Jim Bibee (Knoxville ’50) says. “It was a pleasant surprise to us.”

Bibee began his career as a geologist for Gulf Oil Corporation, which merged with Chevron in 1984, the year he retired as vice-president for worldwide exploration. “I stayed on for another six months as part of the merger team to help downsize the workforce of the new company. The cuts were painful, but necessary,” he says.

Bibee’s route to Tennessee was a circuitous one. Born in North Carolina, he attended the 1st through 8th grades in Mexico, where his father worked in the oil industry. After graduating from high school in 1945 (Gin was in the same class in Laurel, Mississippi), Bibee enlisted in the Army. “When I came out of the service, I knew I wanted to go to college, but I didn’t know where,” he says. “I had an uncle who lived in Jacksboro, Tennessee, so I decided to establish residency there and go to UT, as my father had.”

By then, oil had been “running through his veins” since childhood, so geology was a logical choice as a major. Bibee’s first job out of UT was as a well-site geologist with Gulf Oil in May 1950. “I entered the oil business at an exciting time. Off-shore drilling was in its infancy, and I was fortunate to have been a part of those early explorations,” he says.

The Bibees have been UT contributors since the 1950s. Later, they created the Virginia and James Bibee Endowment in Earth and Planetary Sciences in the College of Arts and Sciences. Gin is an alumna of Mississippi University for Women.

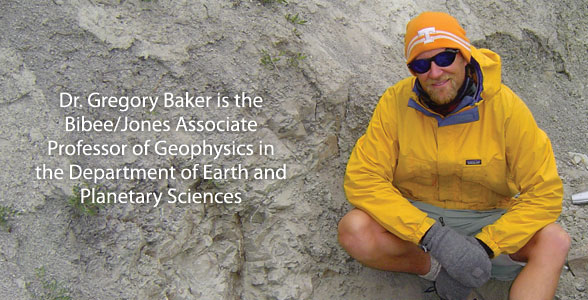

Bibee and his former college buddy and another UT benefactor, Don Jones, decided 2 years ago to establish a professorship in geophysics in UT Knoxville’s Department of Earth and Planetary Sciences. Due to the generosity of these alumni, the department was fortunate to attract Gregory S. Baker, a leader in near surface and environmental geophysics, as the Jones/Bibee Endowed Associate Professor of Geophysics.

Bibee and his former college buddy and another UT benefactor, Don Jones, decided 2 years ago to establish a professorship in geophysics in UT Knoxville’s Department of Earth and Planetary Sciences. Due to the generosity of these alumni, the department was fortunate to attract Gregory S. Baker, a leader in near surface and environmental geophysics, as the Jones/Bibee Endowed Associate Professor of Geophysics.

Using the charitable IRA rollover, the Bibees made an additional gift to geological sciences, which fits with their philanthropic plan and allows them to see the difference their generosity makes at the university. “We discussed the idea with the UT development staff and felt like it was a viable option for us in two-thousand-six, and we are considering it again for two-thousand-seven,” Bibee says. “I think it’s an excellent financial tool for people like us.”

The Bibees will be active in UT’s capital campaign, serving as cochairs in the Houston area.

“We may live farther away from the university than most dedicated alumni,” Gin says, “but we look forward to visiting the campus several times a year, and we try to keep up with everything that’s going on.”

And while Texas oil may run through their veins, it’s probably safe to assume it’s a beautiful shade of Tennessee orange.

New Tax-Saving Opportunity For Donors Aged 70-1/2 or Older

Under the Pension Protection Act of 2006, you can make a lifetime gift to a charitable organization using funds from your individual retirement account (IRA) without undesirable tax effects. Previously you would have had to report any amount taken from your IRA as taxable income. You could then take a charitable deduction for the gift, but only up to 50 percent of your adjusted gross income. This caused some donors to pay more in income taxes than they would have if they had not made a gift at all.

Now these IRA gifts can be accomplished simply and without tax complications. And you can make the gift now, while you can see the benefits of your generosity.

You may contribute funds this way if:

- You are aged 70-1/2 or older.

- The gift is $100,000 or less each year.

- You make the gift on or before December 31, 2007.

- You transfer funds directly from an IRA or rollover IRA.

- You transfer the gift outright to one or more public charities, but not supporting organizations or donor-advised funds.

How It Works

Pat, aged 80, has $450,000 in an IRA and has pledged to give us $75,000 this year. If Pat transfers $75,000 to us from the IRA, she will avoid paying income tax on that amount. She cannot, however, claim a charitable deduction. Pat has found an easy way to benefit us without tax complications. If she desired, Pat could give as much as $100,000. If her spouse has an IRA and is 70-1/2 or older, he can also give as much as $100,000 this year.

How to Do It

Contact your IRA custodian to transfer your desired gift amount to a charitable organization. You can call UT’s planned giving staff with any questions at 865-974-2115, or send an e-mail message to plannedgiving@tennessee.edu.